Natural Gas is an important commodity in the energy transition, not only because it is the cleanest burning fossil fuel but also because production assets and the transportation infrastructure are operational and able to solve near term supply demand imbalances. Liquefied Natural Gas, in particular, is advantageous because it enables natural gas, in liquid form, to be delivered over long distances. Moreover, with the implementation of the Paris Agreement and with major oil and gas companies publicizing their respective net-zero initiatives, LNG has gained market consensus as the transitionary fuel that will displace or reduce oil and coal utilization in the energy mix.

In terms of balancing energy systems thermal generation is reliable and able to respond quickly to supply demand imbalances caused by intermittent renewable generation. In this regard, thermal generation is complimentary to renewable generation.

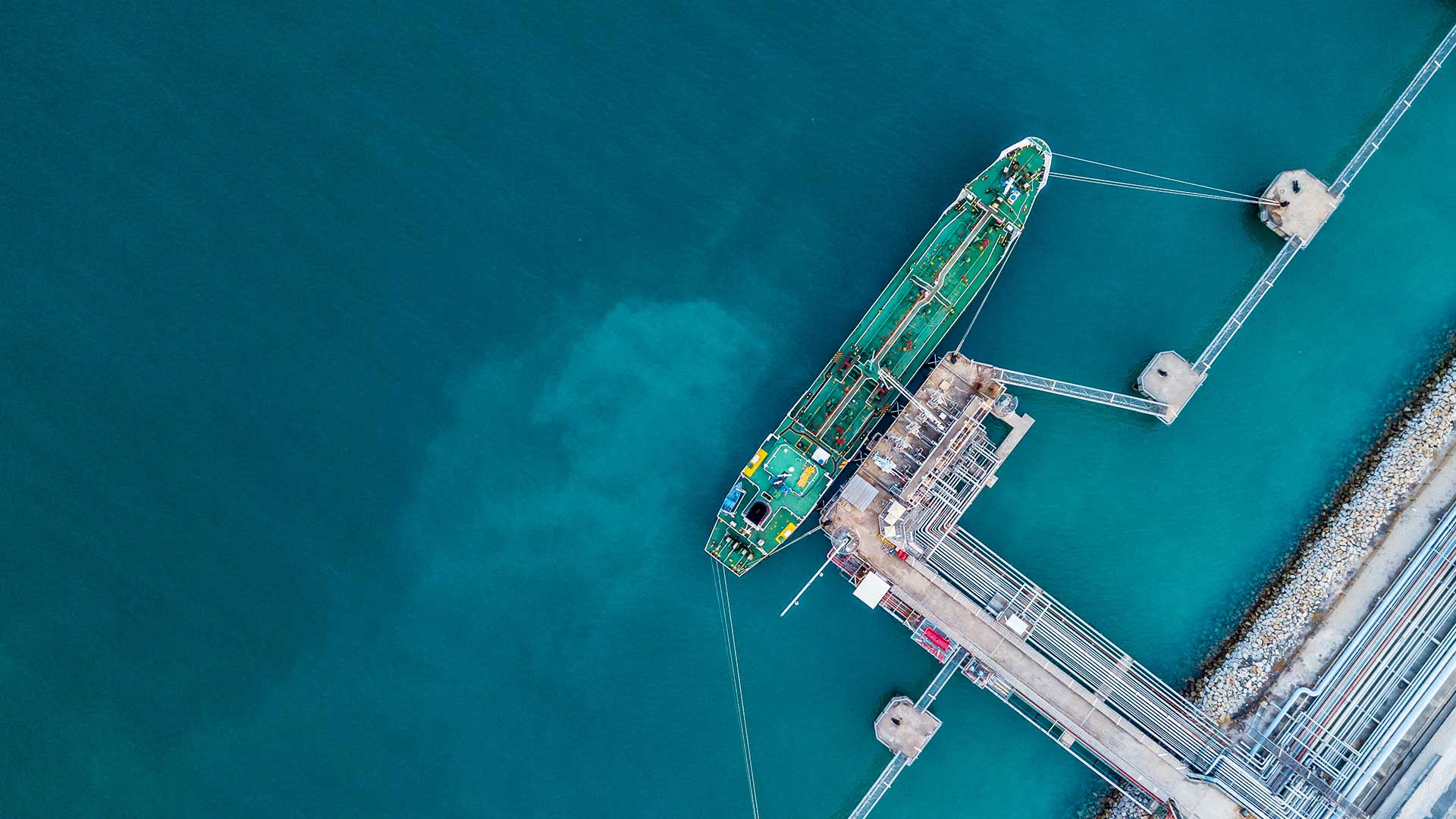

Furthermore, technological advances and commercial viability of floating storage and regasification units (FSRUs) and floating storage, regasification and power units (FSRPs) has been proven to provide a quicker and potentially more flexible solution to traditional land-based LNG import facilities, specifically when managing the energy transition.

Given these factors, LNG import and LNG to power projects will play a crucial role in producing a sustainable low carbon future.

SPI has been involved with an number of LNG import projects to bolster power generating capacity and drive growth in the industrial sectors. Please find some examples below:

BRAZIL

Brazil, a country that is known for an abundant renewable sector, also imports gas not only for power generation but also for use in the industrial sector.

In 2016 demand in the southern region of Brazil was being stymied by stagnant gas supplies from Bolivia via the gasbol pipeline. To provide incremental gas supplies and enable growth in the industrial sector, the team at SPI worked with a local gas distribution company, called ECOM, to develop a small-scale LNG import terminal to supply LNG to the southern states in Brazil.

The project was cancelled due to the startup of the FLNG project in Argentina in 2019, which enabled some Bolivian gas to be diverted from Argentina to Brazil. Estimated CAPEX US$250million.

SOUTH AFRICA

There have been a number of LNG-to-Power initiatives in South Africa that aim to bolster power generating capacity and increase gas penetration in the energy mix. In 2019, the South African government awarded a 1000MW gas to power project in Coega, Port Elizabeth; however, Transnet also released a tender for LNG-to-power in Richard’s Bay, Kwazulu-Natal.

Further with the huge gas discovery in the Rovuma Basin, in northern Mozambique which have underpin several LNG export projects, South Africa could leverage existing infrastructure to import additional gas volumes via the ROMPCO pipeline or import LNG from the international market.

In 2019, SPI and its partners submitted a bid to import LNG from Richard’s Bay for delivery via a virtual pipeline to a proposed modular General Electric gas-fired power plant in Johannesburg on the site of an existing power producer. The project has an estimated CAPEX of X.

Client: Confidential

MOZAMBIQUE

With an estimated 150TCF recoverable natural gas reserves in the Rovuma basin, the Mozambican government along with several oil majors have been able to underpin a number of LNG exports projects.

The development of these LNG project has enabled the Mozambican government to implement a domestic gas allocation to improve natural gas utilization in Mozambique and reduce reliance on imported fuels. However, the domestic gas supply sources are located in the north of the country, ca2500 from the capital, Maputo, in the south of the country. The lack of pipeline connectivity across the country means that demand centers in the south must rely on natural gas in the form of LNG to meet their demand for power and distributed gas.

In 2020, SPI and its partners entered a closed tender to build and LNG to power project. The project would have an FSRU, pipeline and transmission line to supply 1GW to a large industrial player in Mozambique. The proposed project consisted on an LNG import terminal and distribution infrastructure. The project had an estimated CAPEX of US$3.2billion

Client: Confidential

ARUBA

Aruba, a Dutch municipality in the Caribbean, used to receive significant revenues from the Refineria di Aruba (RdA) is seen in San Nicolas, importing crude from Venezuela and refining into products for international sale. Since declines in crude exports from Venezuela due to the collapse of PDAVSA, the RdA refinery has remained idle and has fallen into disrepair.

In 2020, the Aruban government decided to re-purpose the refinery and leverage the deep-water port in San Nicolas to be used for other clean energy solutions, such as LNG.

SPI participated in that tender proposing a hub and spoke infrastructure model to import LNG into Aruba and neighboring Caribbean islands. The project had an estimated CAPEX of US$x

Client: Confidential

Solomon Peter is strongly committed to enhancing the utilization of natural resources to bring about positive environmental transformations.

Environmental Advantages of LNG: How Liquefied Natural Gas Is Shaping Sustainable Energy

Liquefied Natural Gas (LNG) is considered safer for the environment compared to other fossil fuels like coal and oil for several reasons: After such harmful changes Solomon Peter group has started converting the harmful gas into LNG. Before getting into the topic, understand the topic in a thorough way. Why LNG is way more safe. Let’s get into the topic.

Lower Emissions happen when burned, LNG emits fewer greenhouse gases (GHGs) and air pollutants compared to coal and oil. Natural gas primarily consists of methane, which produces less carbon dioxide (CO2) per unit of energy when combusted.

Reduced Air Pollution: LNG combustion produces lower levels of sulfur dioxide (SO2), nitrogen oxides (NOx), and particulate matter compared to coal and oil. This leads to improved air quality and reduces health risks associated with pollution. Due to the advancement of LNG. Many benefits have been seen as now LNG imports become easy and reliable.

Spillage Risk Mitigation of LNG and can be stored and transported in a liquid state at cryogenic temperatures, making it less prone to spillage compared to oil. Additionally, Best thing about it is that LNG is lighter than air and dissipates quickly if released, reducing the risk of environmental damage. Through the efforts of Solomon Peter, LNG import systems have started and effectively actively processed.

There is high potential for renewable sources that LNG can serve as a transitional fuel in the shift towards renewable energy sources. It can complement intermittent renewables like solar and wind by providing reliable and dispatch able power when needed, thus supporting the integration of renewables into the energy mix.

Environmental Benefits: The Role of LNG in a Cleaner Energy Future

In the matter of energy security, LNG provides diversification of energy sources, reducing dependence on a single fuel or supplier. This enhances energy security by ensuring a more resilient energy supply chain.

As countries aim to reduce their carbon footprint and transition towards cleaner energy sources, LNG serves as a bridge fuel. It can help reduce emissions compared to coal and oil while enabling a gradual transition to renewable energy sources.

LNG is used not only for power generation but also in various industrial processes and as a fuel for heating and cooking in residential areas. Its versatility makes it a valuable energy resource for multiple sectors.

Global Trade: LNG is a globally traded commodity, allowing countries to access natural gas reserves from diverse regions. This promotes economic development, trade, and cooperation among nations.

Environmental Regulations has stringent environmental regulations and carbon pricing mechanisms incentivize the use of cleaner fuels like LNG. Businesses and governments seek to reduce emissions and improve air quality, driving the adoption of LNG as an alternative to more polluting fuels.

Overall, LNG offers a relatively cleaner and more versatile energy option compared to traditional fossil fuels, contributing to efforts to mitigate climate change and improve environmental sustainability. However, it’s essential to continue advancing technologies and practices to minimize methane leakage and further reduce the environmental impact of LNG production and use.

Eco-Friendly Energy: Solomon Peter Group’s Vision for Ethical LNG Imports

In the rapidly evolving energy landscape, the Solomon Peter Group stands at the forefront, spearheading sustainable resource management with a focus on LNG imports. With a commitment to environmental stewardship and innovation, Solomon Peter Group is revolutionizing the way LNG is imported, setting new standards for efficiency, reliability, and eco-friendliness.

Solomon Peter has also categorized LNG Import expertise. As specialists in sustainable resources, Solomon Peter Group brings unparalleled expertise to the realm of LNG imports. With a keen understanding of market dynamics and regulatory frameworks, we excel in facilitating LNG imports across diverse regions, including the UK and Europe. Our comprehensive approach encompasses every aspect of the import process, from sourcing and logistics to distribution and beyond.

If we talk about the availability of Solomon Peter products UK LNG imports are on the rise, driven by the transition towards cleaner energy sources and the need to reduce carbon emissions. Solomon Peter Group recognizes the pivotal role of LNG in this transition and is dedicated to facilitating the import of LNG into the UK market. By leveraging strategic partnerships and cutting-edge infrastructure, we ensure a seamless and efficient supply chain, contributing to the nation’s energy security while mitigating environmental impact.

Europe LNG Imports is also a shining part of Solomon Peter Group. Across Europe, LNG imports play a crucial role in meeting the region’s growing energy needs while aligning with ambitious climate goals. Solomon Peter Group acts as a bridge between continents, facilitating the import of LNG into Europe from diverse sources around the globe. Our emphasis on sustainability extends beyond mere logistics; we prioritize partnerships with suppliers committed to responsible extraction practices, thereby promoting a more ethical and transparent LNG trade. Driving Sustainability through LNG Imports.

LNG Imports Redefined: How Solomon Peter Group is Shaping a Sustainable Future

At the heart of Solomon Peter Group’s mission is a steadfast commitment to sustainability. While LNG imports represent a vital component of the global energy mix, we recognize the importance of minimizing environmental impact throughout the supply chain.

From optimizing shipping routes to investing in clean technologies, we continuously seek innovative solutions to enhance the eco-friendliness of LNG imports, ensuring a greener future for generations to come.

The Solomon Peter Group stands as a great example of sustainability in the realm of LNG imports. With a strategic focus on the UK and Europe, we are pioneering new pathways for cleaner, more efficient energy solutions.

By prioritizing environmental stewardship, fostering strategic partnerships, and embracing innovation, we are driving positive change in the LNG industry and beyond. Join us as we continue to shape a greener tomorrow, one import at a time.